MCA introduces new e-form AGILE

Legal & Compliance

313 week ago — 8 min read

Background: On 29 march 2019, the Ministry of Corporate Affairs (MCA) introduced a new e-form AGILE. This is a new reform towards compliance introduced by the government. Anyone intending to incorporate a company through the SPICe e-form and having a registered office can now apply for Goods and Services Tax Identification Number (GSTIN)/establishment code as issued by Employees Provident Fund (EFPO) through this e-form with effect from 31 March 2019.The applicability of this form will help in incorporation of new companies and company registration under various other authorities will become easier and faster. In his previous article Ravi Kariya shares everything about registering a Private Limited Company and form SPICe for registering a company electronically. In this article, he explains all about e-form AGILE and FAQs related to it.

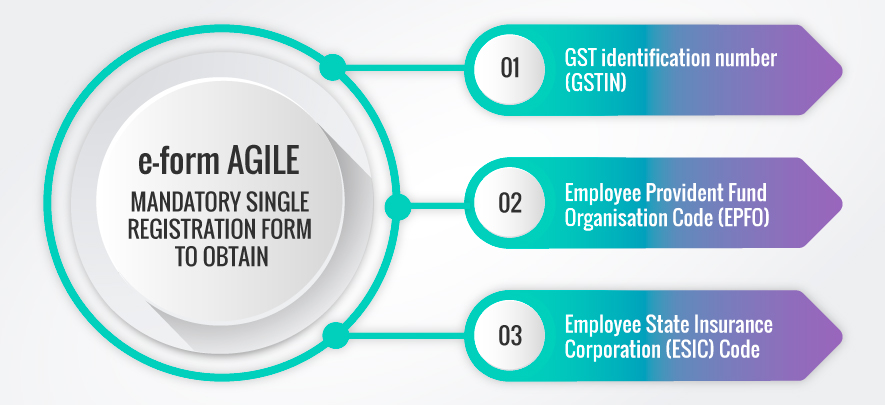

What is e-form AGILE?

The MCA has notified e-form known as AGILE which is an application for registration of the Goods and Services Tax Identification Number (GSTIN), Employee State Insurance Corporation (ESIC) and Employee Provident Fund Organization (EPFO) registration. This AGILE form will be a part of SPICe Incorporation e-form and covers three important registration required for every business namely GST registration, PF registration and ESIC registration.

By filing e-form AGILE (also known as form INC-35) along with SPICe incorporation form at the time of registration, a company would be automatically registered for GST, ESIC and EPFO. It may be noted that in existing regime of filing SPICe, Permanent account number (PAN) and Tax deduction and collection account number (TAN) of company are simultaneously issued. The notification that came in this regard said that SPICe shall be accompanied by e-form AGILE with effect from 31 March 2019, as notified by the government.

This will largely benefit many aspiring entrepreneurs who now will not have to deal with different government authorities for various registrations.

Dates for applying registrations through e-form AGILE are prescribed as follows:

For GSTIN: with effect from 31 March 2019

For EPFO: with effect from 8 April 8 2019

For ESIC: with effect from 15 April 15 2019

FAQs on e-form AGILE (Source MCA)

1. Who all can apply for GSTIN through MCA AGILE form?

- Any user who intends to incorporate a company through SPICe e-form can now also apply for GSTIN through this e-form. The application (SPICe) for incorporation of a company shall be accompanied by a linked e-form AGILE to obtain GSTIN along with other applicable forms.

This process will be applicable only for companies incorporated by MCA through SPICe application. Other categories of applicants, viz. tax deductor, tax collector, casual taxable person, ISD, Special economic zones (SEZ) registration, ISD registration etc. shall follow the existing process of registration through a common portal for GST registration.

2. Is it mandatory to file INC-35 at the time of submitting SPICe form?

- Yes. The application (SPICe) for incorporation of a company shall be accompanied by a linked e-form INC-35 (AGILE) with effect from 31st March 2019, as notified vide the Companies (Incorporation) Third Amendment Rules dated 29 March 2019.

- Though, it is optional to apply for GSTIN at the time of incorporating company, filing of INC-35 form along with SPICe form is mandatory.

3. My registered office of business is in State ‘X’ but I want to obtain GSTIN for State ‘Y’. Which state should I select in AGILE form?

- The registered office of the proposed company as provided in the SPICe shall be the principal place of business for GST application. Select the same state and district in AGILE form (INC-35) in which the registered office of proposed company exists i.e. enter the same state and district as entered in SPICe form.

4. Where can one find Ward/Circle/Sector No.?

- Please refer your state website to know your Ward/Circle/Sector No.

5. Where can one find Center Jurisdiction?

- Please refer to : Find Here.

6. I want to/do not want to opt for Composition. How do I make sure my choice is exercised?

- There is a checkbox to declare whether you wish to opt for Composition or not. Please make the appropriate choice.

7. How many proposed Directors can I add in the AGILE form?

- Details of proposed Directors to be entered in AGILE form would be based on the class, category or sub-category entered in SPICe e-form. Number of Directors shall be one in case of OPC, two in case of private company, three in case of public limited company and five in case of Producer Company respectively.

- Note: The details of such proposed Director entered in AGILE form should match the details as entered in the SPICe form for the same person.

8. Is it mandatory to provide Harmonized System Nomenclature (HSN)/Service Classification Codes?

- You are required to provide HSN code for goods or service classification code for service.

9. Where can one find HSN Code for the supply of any of the products?

- For HSN code: kindly refer to Central Board of Indirect Taxes website under GST Tab (cbic.gov.in) and choose appropriate HSN Code.

10. Where can one find SAC Code for the supply of any of the services?

- For SAC code, kindly refer to Central Board of Indirect Taxes website under GST tab (cbic.gov.in) to choose the appropriate Service Classification Code.

11. Who shall sign the AGILE form MCA?

- The director who has signed the SPICe e-form should sign the AGILE form. Both SPICe form and AGILE form shall be signed by the same director.

12. I do not have registered office of company at the time of submitting SPICe and other linked forms. Can I apply for GSTIN?

- The registered office of the business entity provided in the SPICe will be the principal place of business for GST. GSTIN can be applied only if address for correspondence is same as address of registered office of the company entered in SPICe form.

13. I have submitted my AGILE form along with SPICe form successfully. When will I receive GSTIN?

- Once the company is incorporated at MCA portal and Certificate of insurance (COI) and PAN has been successfully generated, required information will be forwarded to GSTN for processing of form. Once the data is successfully validated by GSTN, Temporary Reference Number (TRN) and Application Reference number (ARN) would be generated and displayed on MCA Portal. In case of approval / rejection, GSTN will send GSTIN / rejected status on mobile number and email of authorized signatory.

14. I have received TRN but received the email for validation errors. Where do I need to resubmit the corrected form?

- In case of validation errors, GSTN will intimate the user to correct and resubmit the form. For this, you are requested to login through TRN at GST portal – gst.gov.in and submit the correct form.

15. When my TRN gets expired. What is the consequence?

- TRN expires 15 days after it is generated. You need to submit a fresh application for registration of GST at GST portal.

16. Is there any fee to be paid while applying GSTIN?

- No.

17. What is the maximum upload size of AGILE form?

- 6MB

To explore business opportunities, link with me by clicking on the 'Connect' button on my eBiz Card.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views, official policy or position of GlobalLinker.

Posted by

Ravi Haresh KariyaEbizFiling.com is a motivated and progressive firm managed by like-minded people. It helps a variety of small, medium and large businesses to cater to all compliance requirements...

Network with SMEs mentioned in this article

View Ravi 's profile

Other articles written by Ravi Kariya

How to register an LLP in India?

247 week ago

How to register a Proprietorship Company in India?

247 week ago

How to register Private Limited Company in India

247 week ago

Most read this week

Comments (1)

Share this content

Please login or Register to join the discussion