NITI Aayog: Definition, eligibility and registration process

Legal & Compliance

294 week ago — 4 min read

Background: The NITI Aayog was started by the government of India on 1 January 2015. It was started as a think tank to promote national development, foster cooperative federalism, create a knowledge and entrepreneurial support system through a community of national experts. The NITI Aayog aims to provide state and central governments with strategic and technical advice to run governance that is people-centric, policy-driven, transparent and collaborative. Navneet Dhiman in his previous article shared the advantages and documents required for bar code registration in India. In this article, he shares the eligibility for NITI Aayog registration, the registration process and steps.

Definition of NITI Aayog

The National Institute for Transforming India is also called NITI Aayog. NITI Aayog is also developing itself as a state-of-the-art resource centre, with the necessary resources, knowledge and skills, that will enable it to act with speed, promote research and innovation, provide strategic policy vision for the government, and deal with contingent issues.

NITI Aayog eligibility

Any NGO/ Trust / Section 8 company are eligible to register themselves under NITI Aayog.

Also read: Right to Information Act: Frequently asked questions

Can an individual register under NITI Aayog?

As of now no individual person are not allowed to register under Niti Aayog. All voluntary organisations/Non Government Organisations are mandatory to register under Niti Aayog for receiving grants under various schemes of Ministries/ Departments/Government Bodies.

Benefits of Niti Aayog

- Advantages of NITI Aayog registration for NGO

- Recognition from the government

- Transparency guaranteed

- Helpful in getting government grants

- Trust factor

- Unique registration ID from government of India’s NGO Darpan.

Also read: Government proposes major labour law changes for ease of compliance

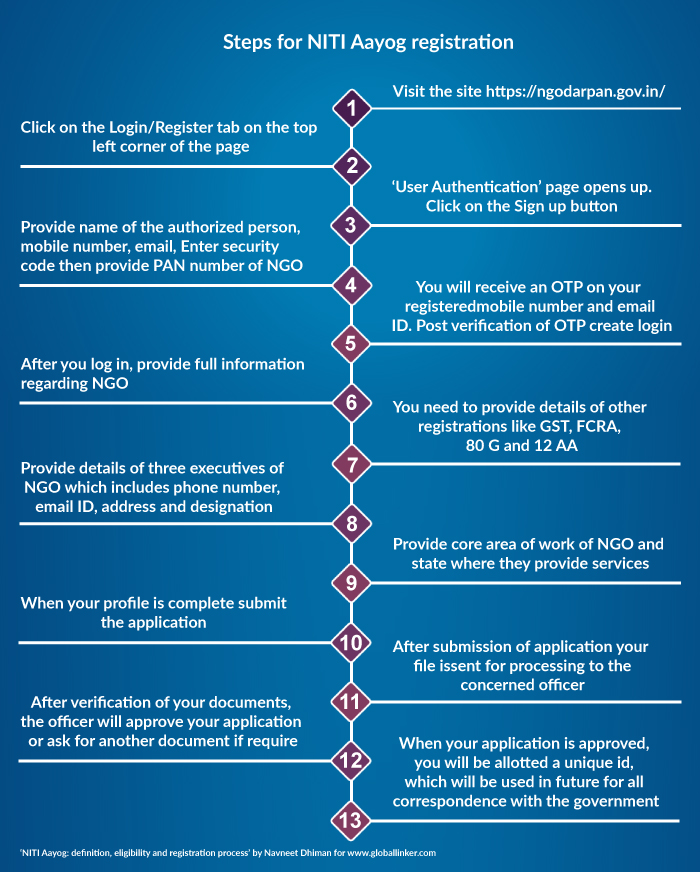

Registration process and documentation required

The Registration process involves 4-5 working days. Following documents are required for registration purpose:

þ Details of Chief Functionary/Chairman/Secretary/Other office bearers

þ KYC documentation of the above persons; PAN card and Aadhaar card

þ PAN card of the organisation;

þ Registration certificate of the organisation

þ Memorandum and articles of association, in case of company (sec. 8 or sec. 25)

þ Details of Chief Functionary/Chairman/Secretary/Other office bearers

þ KYC documentation of the above persons; PAN card and Aadhaar card

þ PAN card of the organization

þ Registration certificate of the organization

þ Memorandum and articles of association, in case of company (sec. 8 or sec. 25)

Also read: Trademark your brand to safeguard your brand

Image courtesy: shutterstock.com

To explore business opportunities, link with me by clicking on the 'Connect' button on my eBiz Card.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views, official policy or position of GlobalLinker.

Posted by

CS Navneet DhimanHis Passion has been over the years to help inject techno-legal innovation and compliance strategy into Mylex Infotech Pvt Ltd. With the expertise in the compliance and legal...

View CS Navneet 's profile

Most read this week

Comments

Share this content

Please login or Register to join the discussion