Startup funding: A comprehensive guide for entrepreneurs

Finance & Accounting

264 week ago — 22 min read

Startup funding is definitely a popular topic which is discussed in the world of startups today. A lot of entrepreneurs have asked me about Startup Funding. There seems to be a lot of myths surround the subject of startup funding. So I decided to create a three part video series along with the article to help aspiring entrepreneurs through the funding cycle. The first section and the video talks about the prerequisites of funding, followed by the sources of funding and the process of funding.

Section 1: Pre-requisites of funding

Gone are the days where you can get funded based on an idea. In order to secure funding you must establish the feasibility of your idea through proper planning and implementation. You must have a prototype or a minimum viable product. You should also establish the proof of concept of your business before you qualify for funding.

Here are some ground rules you must understand before you start looking for funding.

- Firstly, Not all businesses are fundable – A business must satisfy a certain set of criteria before it qualifies for funding. A business is only fundable from an investors point of view if it has the potential to scale up and give exponential returns.

- Secondly, you must remember that funding is not an indicator of success. – Irrespective of the impression that you might get from the news and media. Funding is just a stepping stone. Many businesses around us has grown without any funding. So funding might be a need in some cases, but its not an absolute necessity.

- Which brings me to the third point. Your business should be self-sustainable. The primary source of your funds should be your paying customers i.e. your business should generate enough revenues and profits to fund the growth and expansion. Only in the case that this is not possible or there is a specific need for additional funds then only you should look for funding.

Let’s talk about some of the reasons why you should look for funding.

- One of the most prominent reasons for funding is to scale up your operations, for expansion and achieve economies of scale. For example: You have already started a business and successfully implemented your idea and its running well. Now you may want to scale up your operations or expand your presence. This is the point you should definitely consider funding.

- The next reason is to establish a competitive advantage over your competition and quickly acquire a substantial market share. Let’s take an example – In case of an internet or app business, the user traction and market penetration is a must. Getting users organically might take a lot of time and your competitors may take advantage of the situation. So, to get a large number of users inorganically, you would need funding. You must have seen a lot of startups giving out promotions, discounts and incentives at the early phase of their business. This is primarily to gain market share and a dominant market position.

- The third reason is to fund your short term operational expenses or working capital. For example – A small manufacturing firm suddenly receives a large order. To fund the sudden spike in production, funds will be required for additional inventory and wages. Once the order is fulfilled and paid for, the funds can be paid back.

- In very few specific cases, depending on the nature of the business, the business model might demand a large gestation period or extensive research and development. For these businesses it is imperative to get funding from the start without which the business cannot be setup. For example – Any custom manufactured IoT device would require software development as well as hardware customization. Both of which are expensive and time consuming. It is going to cost a lot of money just to get the initial batch of products to test the market and would definitely require external funding. This kind of funding is only applicable if the product is unique and innovative.

Apart from these reasons and leaving a very few special case exceptions, you would struggle to justify your funding need. Do not get funding because it is cool or it’s fashionable. Ensure that you create a strong foundation of the business before looking for funding. Seeking funds for wrong reasons is clearly a recipe for disaster.

Section 2: Sources of funding

Let’s start with the different forms of funding.

- Firstly, we have equity investments. This is definitely the most popular and most talked about avenue for startup funding. These investments are done in lieu of shares or equity in your startup. The shares given out can either be common stocks or preferred stocks.

- Then we have the debt investment which would have a repayment timeline and incur interest rate. Debt investment are primarily in form of long term loans (personal or commercial) and short term loans in form of invoice debts and working capital loans.

- The third form is royalty based investment. This a very interesting mode of funding. In lieu of funding you pay the investors a structured royalty which is a portion of the sales. The royalty may be of a limited timeline, variable rate or perpetuity based on the investment agreement.

- Convertible bonds and convertible equity are also another form of funding. Under this mode the stakeholders would have an option to interchange between debt and equity investment based on a pre agreed terms and timelines.

In reality, investments can either be purely in one of these forms or may be structured as a combination of multiple forms. It is important to understand the funding structure stated in your term sheet and the advantages and disadvantages it may have for your business. For example, in case of royalties and debt investment you will have a regular cash outflow which might be a hindrance to the future growth. In case of equity, you must be prepared to give out a substantial portion of the equity over several phases of funding to the extent that you might not have the controlling share in your own company.

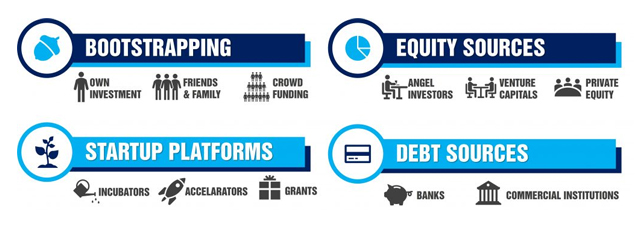

Now let’s see what are the sources of funding.

- I always recommend that you start with bootstrapping. Bootstrapping is when you put own money or borrow from friends and family to setup your business. Bootstrapping inculcates the entrepreneurial discipline and financial responsibility to run a lean business.

- Crowd funding is also an option where you can raise funds through crowd funding platforms like Kickstarter but unfortunately Indian regulation only allows crowdfunding for some non-profit businesses.

- Participating and winning Startup competitions can also help you to accumulate some funds along with gaining some credentials and as well as getting some media mentions.

These were the options for initial setup.

- Then we have startup platforms like incubators and accelerators. These usually play a role in very early stage of your business primarily pre-revenue. Accelerators and incubators support the startups with a small amount of funding, mentorship, networking opportunities, resources and workspaces.

- You should also research the government programs like subsidies, funding and grants that are available for your business sector and ensure you understand the parameters to qualify for these.

- The third source of funding is from equity investors. Under this category you have the angel investors who would invest their own money and Venture Capital or VC firms, who manages funds aimed towards specific startup sectors and stages. For matured businesses there is Private Equity or PE firms.

- The fourth source of funding is debt investors which is usually banks and commercial institutions. The crudest form of debt funding is through credit cards. I have interacted with a lot of founders who actually funded their initial business expenses through credit cards. I would not suggest this unless it’s a dire necessity. Because credit cards tend to have extremely high interest rates along with the personal liability to pay back. The second form of debt funding is personal loans. You can get a personal loan without a business plan. Personal loans would also have a personal liability to pay back and interest rates are comparatively higher than commercial loans. Which brings me to the next form of debt i.e. commercial loans. This is the most popular form of debt investment for businesses. Unfortunately commercial loans from banks and lending institutions is very difficult for a startup and usually requires collateral.

Now let’s have a deeper look in to the different stages of equity based funding.

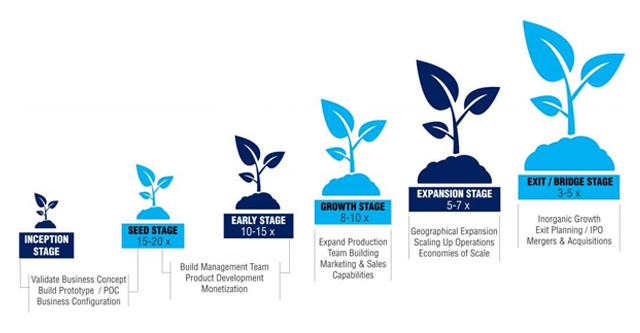

- The inception stage is primarily focused on building the prototype or the minimum viable product and validating the business concept. It is almost impossible to raise funds at this stage unless you have a proven entrepreneurial record of creating a large business. So, I would suggest that you bootstrap during the inception stage.

- Once you have established the feasibility of the business concept and created considerable traction for your business, it is now suitable for the seed stage. At this stage the investors would be expecting at a return of 15 to 20 times their investment over a period of 5 to 7 years. The seed stage is focused on building the core team, product optimization, exploring avenues for monetization.

- Once you have created the footprint in the market the business qualifies for Early stage investment. An early stage investor usually looks at a return of 10 to 15 times. Early stage funding is primarily focused towards business expansion and increasing customer traction.

- Once the business has established a solid market position, and is at a point of influx, the investment stages that follow are growth and expansion stages. The core focus of these phase are business expansion and scaling up. For these phases, investors usually expect 5 to 10x return.

- The bridge or exit stage is usually of very large transactions and for companies with substantial valuation. These phases are focused on inorganic growth, mergers, buy outs, acquisitions and exit preparation for the business. During this phase investors usually look for a 3 to 5 x return on the capital invested.

As you can see the expected return for the investment gets lower as the business grows. This is primarily because the risk is reduced as the business matures. As the business grows bigger it becomes more stable and sustainable. So earlier you raise funding more equity you would need to shell out.

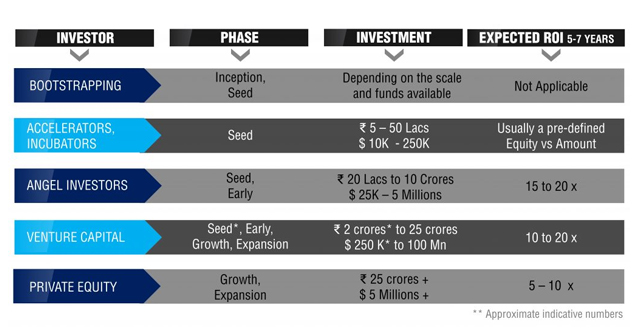

Let’s have a look at the investment ranges for different categories of investors. This chart will give you an indication of the quantum of funds invested by each category of equity investors. Please note these numbers are just an approximation and may vary case to case.

Section 3: Process of funding

What do investors look for before investing?

Before we dive into the process of funding, let us understand what do investors look for before investing. What are the investment criteria from the investors point of view that drives an investment?

What do investors look for in a startup

- The starting point is definitely the idea and its potential. The idea must be feasible, scalable, unique, innovative and must have a market opportunity.

- The investors also focus on the business including the credibility and credential of the core team and their ability to execute the idea. The business

model and revenue model along with your positioning, pricing and cost structures are equally important. - Investors not only focus on the present but also the future potential of the business which can be showcased through a well drafted business plan which includes the business strategies, the usage of funds, value proposition and the exit strategy.

- Along with all of these the most important point that the investors look for is the return on investment. It is important that the investors feel confident of the investment proposition and are convinced that they will be able to earn back their investments.

What are the essential components of your pitch?

Before approaching investors for funding, you must prepare your pitch. The essential components of your pitch include a comprehensive business plan with projections of 5 years along with investment offering and estimated valuations.

Along with the business plan you must have a well-designed investor deck which is a presentation of around 15 to 25 slides summarizing the business plan. The investor presentation comes in handy when you present in front of the investors.

Your pitch also needs to have a well drafted executive summary also called teaser summary. This is a 2 pager document summarizing the overall business plan. Teaser documents are usually used to initiate a formal communication with the investors.

You should also prepare an elevator pitch which is a 5 minute verbal summary of your business idea and the plan. It is called an elevator pitch because you should be able to pitch to someone over an elevator ride. Elevator pitch comes in very handy to pitch to investors when you meet them in events or conferences.

You must spend adequate time and effort researching, creating and preparing the components of the pitch before approaching the investors.

If you need any professional help to create your business plan and pitch documents feel free to contact the team at BplanExperts.com. They have the experience of helping over 1600 startups across 80 countries. They will surely help you.

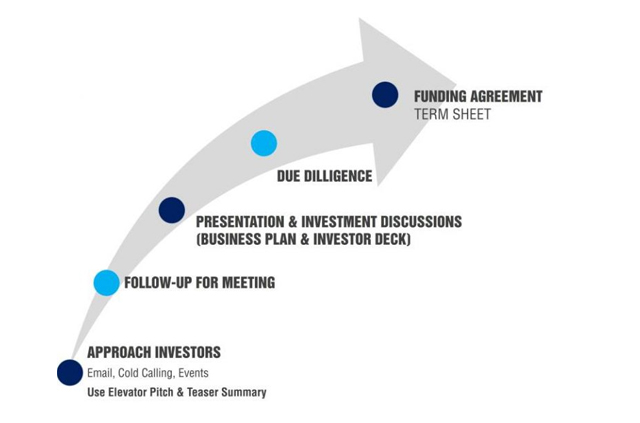

How to approach Investors?

Once you have the pitch along with its components ready you should start approaching investors. You can meet investors in startup events or competitions. You can also proactively reach out to investors by sending them emails with the teaser document and follow up for a meeting. You can also reach out to investment forums or investment networks or get referrals from mentors.

The fund seeking process can be time consuming, difficult and challenging. You must understand that you will face a lot of rejection, but you will have to be relentless. Also ensure that you balance your time between fund seeking and running your business because without a running business there is no question of funding.

Understanding the investor’s psychology

It’s is also very important that you understand the investor psychology.

- First is the investablity of your business. Entrepreneurs are passionate as they want to change the world or solve a problem but don’t expect the investors to be as passionate as you are about your business. The investors would invest in your startup primarily to make money. So, it is important that your business offer a lucrative investment opportunity.

- Investors usually carry a portfolio of startups. So, it is natural for them to fund companies which are complementary to the startups already in their portfolio. This is because the startups can complement each other’s businesses. For example, if I have an ecommerce venture in my portfolio, investing in a logistic startup or a payment gateway startup would make a lot of sense as they can be integrated. Moreover, there is always a possibility of a future merger and consolidation. So do your research into the investor’s portfolio to before pitching.

- Investors tend to invest in a hot trend. You will see whenever an innovative business pops up, a lot of similar businesses come up within a short period of time. This is based on the phenomenon called economic pendulum. So why do investors invest in similar business. If a major investor invests in a type of business, the other investor looks for their competition to fund. Primarily because the market is nascent so who ever executes properly would gain the market share. Moreover, similar business of scale with varied market reach are easy target for acquisition which ensures an exit for the investor. For example: Uber, Ola and TaxiforSure, which was acquired by Ola and then you have Oyo, Fab Hotels and Treebo. If you know other such examples, mention them in the comments. I would love to know about them.

- Investors look for a balance, a sweet spot on the competition scale. They avoid businesses which aims to create a completely new category. Because then the business would need to create awareness for the category, educate people and then create awareness of the product. Which in turn makes the job very difficult. They also avoid highly saturated market, full of competition. The sweet spot lies in between. They look for an untapped market within an existing business category.

- One of the things the investors hate to hear is the “market share syndrome”. Often entrepreneurs pitch from the viewpoint of market shares. They say “The market is so and so billion and if we manage to get 1% market share we will have a company worth x million.” But, in reality things don’t quite work that way. So, you should always avoid going the market share route. The research you do for the market and its growth is solely to substantiate the business case.

Once you understand the psyche of the investors, you can optimize your pitch accordingly.

Things investors won’t tell you

Now here are some of the things that investors won’t tell you.

- Point number 1: You must understand that funding is a business transaction between the investors and the startup founders. Just like a startup would need funds from the investors, the investors are also eager to invest in lucrative startups. It is a symbiotic relationship. It has to be a right fit. So, you must ensure that you do your due diligence on the investors, their sources of funds, their management style and support system they offer before signing the deal.

- Point number 2: Do not raise funding more than what you require. Capital is expensive. Raising higher capital at an early stage means more equity to be diluted to the investors. And also, additional funds often result in unwise spending.

- Point number 3: Never raise money with an increased valuation. It might be tempting to do so. But, in subsequent rounds of funding inflated valuation will be normalized resulting in a down round. This makes the existing investors extremely unhappy and tarnish the market reputation of the company. You might have seen that valuations of several unicorns were suddenly slashed down. If you remember, Flipkart was valued at 15 Billion dollars in June 2015 but Morgan Stanley slashed its valuation to 5.37 billion dollars in 2017.

- Point number 4: When you raise funds, you are literally married to the investor. In subsequent rounds if your existing investors do not re-invest, it gives out an indication that something is wrong. Other investors might think that the existing investors might know something which they don’t, so they are very cautious of investing in such a scenario.

- Point number 5: It’s not just about the money. You must understand that you as a founder must gel with the investor. Your vision and goals must be aligned. A lot of funded startups fail due to expectation mismatch between the founders and the investors.

- Which brings me to the next point. You must understand the responsibilities that come up with funding. Managing investor relations, compliance, and Reporting. All of these requires additional time and effort. So, it is extremely important that you manage investor expectations and maintain transparent communication with your investors at any point of time.

So, with this we conclude the 3 part series of startup funding. Hope these videos and the article have helped you to get an overview of startup funding. If you need any help with your business planning and funding exercise feel free to contact the team at Bplan Experts.

Did you check out Crazy About Startups? It is made just for you. Get recent updates from the startup world, learn from experts and network with fellow entrepreneurs, investors and mentors. And it’s all for free. Register at crazyaboutstartups.com and download the android app today. You can also connect with me on Crazy About Startups. Hope you liked the videos and if you did please press the Like button. If you have any queries please put them the comment section below and I would love to answer them. Follow my blog at Arnab.co and don’t forget to Subscribe to this channel as I will be coming up with fresh new videos every week. Wish you all the best. Until we meet again.

Image source: shutterstock.com

To explore business opportunities, link with me by clicking on the 'Invite' button on my eBiz Card.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views, official policy or position of GlobalLinker.

Posted by

Arnab RayArnab is an entrepreneur, management consultant, mentor and an early stage investor, deeply involved in the startup ecosystem. Arnab is the CEO & Managing Director at Array...

View Arnab 's profile

Other articles written by Arnab Ray

14 week ago

5 myths about business planning

135 week ago

Most read this week

Comments

Share this content

Please login or Register to join the discussion