Budget impact: Taxation on businesses

Tax & Auditing

300 week ago — 6 min read

Background: In his previous article, tax expert, Ritul Patwa elaborated on the budget impact on key deductions and benefits under income tax for individuals. In this article he shares about the impact of budget on business taxation.

Here is an overview of the budget impact of taxation on businesses.

Rate of income tax on partnership firms & LLPs

(i) Rate of Income Tax @ 30 % of Total Income

Surcharge– If Total Income up to 1 Crore – NIL

If Total Income > 1 Crore – 12%

Health & Education Cess– 4%of the Income Tax & Surcharge (replaced 3% cess in preceding year)

(ii) Expenses that can be claimed only if mentioned in the partnership deed of the firm

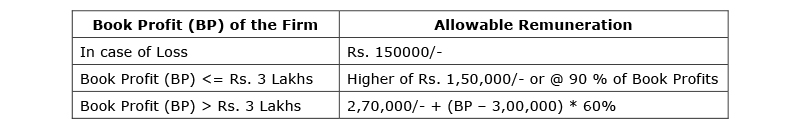

a) Remuneration permissible to Partners – subject to limit prescribed below:

b) Interest on Partners Capital (if provided in the Partnership Deed) is allowed up to a

Maximum of 12 % p.a.

Presumptive computation of profit of business of resident individual, HUF & partnership firms

(i) For small businesses (Section 44 AD)

[Not applicable on LLPs, professions referred u/s 44AA(1), commission/ brokerage income & agency business]

Turnover upto Rs. 200 Lakhs

Deemed Profit –

a) 6% of Gross Receipts received by an account payee cheque or account payee bank draft or use of electronic clearing system through a bank account or such other electronic mode as may be prescribed during the previous year or before the due date specified in sub-section (1) of section 139 in respect of that previous year;

b) 8% of Gross Receipts other than those covered in para (a) above.

(ii) For small resident professionals (Section 44 ADA)

[Applicable for Professionals engaged in Profession referred to u/s 44AA (1)]

Gross Receipt up to Rs. 50 Lakhs

Deemed Profit – 50% of Gross Receipt

Issues related to Presumptive Profit that need attention

1. An Eligible Assessee is allowed to declare profits in excess of the Deemed Profit;

2. If an Eligible Person wants to declare profit, lower than the Deemed Profit prescribed u/s 44AD or 44ADA, then he is required to get his accounts audited in accordance with Income Tax Act, 1961.

3. For Partnership Firms declaring their presumptive profit u/s 44AD or 44ADA, the Partners Remuneration and Interest are not allowed to be deducted from the ‘Deemed Profit’ derived under the aforesaid sections. They are presumed to be part of the expenses.

Benefits of presumptive computation of profits

1. Exemption from the compliance burden of maintaining books of accounts.

2. Exempted from advance tax and allowed to pay their entire tax liability before the due date of filling the return or actual date of filing their return whichever is earlier.

Also read: Key takeaways from the Angel Tax proposal

Rate on income tax on companies

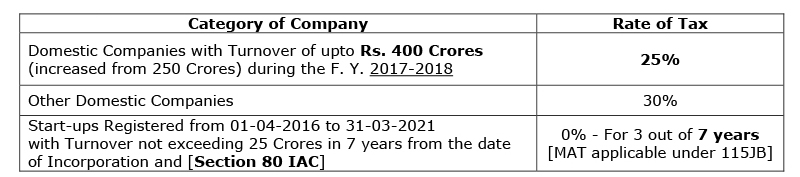

(i) Domestic companies

(ii) Other non-domestic companies

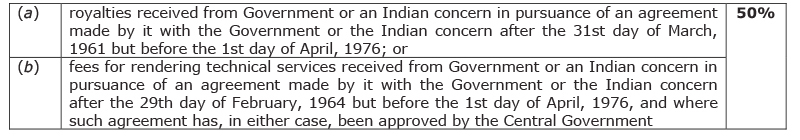

(1) on so much of the total income as consists of-

(2) on the balance, if any, of the total income – 40 %

Rate of Surcharge –

a. Domestic company

Total Income up to 1 Crore – NIL

Total Income > 1 Crore and up to 10 Crores – 7 %

Total Income > 10 Crores – 12 %

b. Other Companies

Total Income up to 1 Crore – NIL

Total Income > 1 Crore and up to 10 Crores – 2 %

Total Income > 10 Crores – 5 %

Health & Education Cess – 4% of the Income Tax & Surcharge (increased from 3% in FY 2017-18)

(i) Minimum Alternate Tax (M.A.T.) - Applicable where the Book Profits are more than Profits as per Income Tax Act, 1961.

a) The rate of MAT payable by a company is 18.50% u/s 115 JB.

b) The period allowed to carry forward the tax credit under MAT is further extended to 15 years.

(ii) Dividend Distribution Tax (Sec 115 O) is 15% but in case of dividend referred to in Section 2 (22) (e) of the Income Tax Act, it has been increased from 15% to 30%.

(iii) On Buy Back of Shares (Sec 119 QA) - Tax has to paid @ 20%

Also read: Decoding the budget

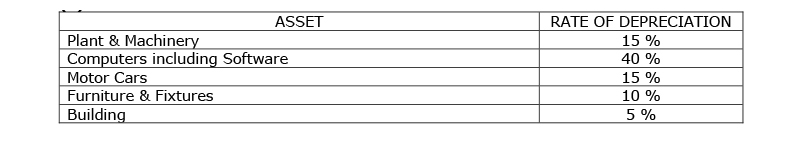

Rates of depreciation under Income Tax Act

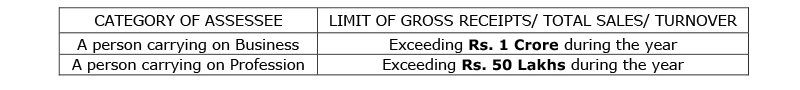

Turnover limit for audit under Income Tax Act

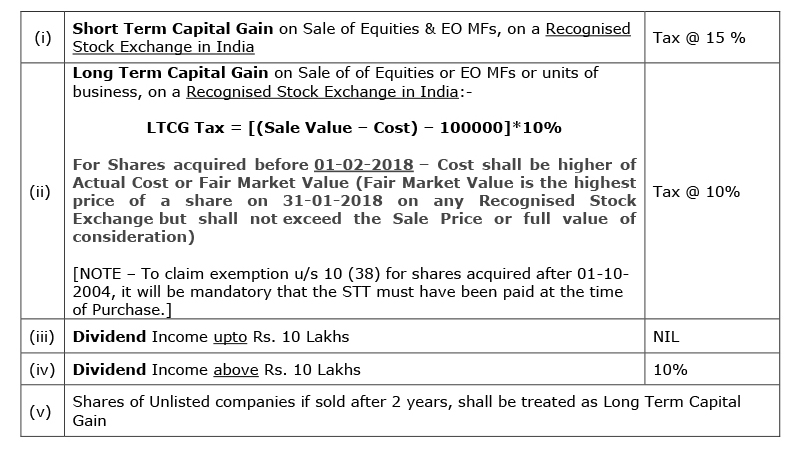

Taxation of equities (shares) & dividend

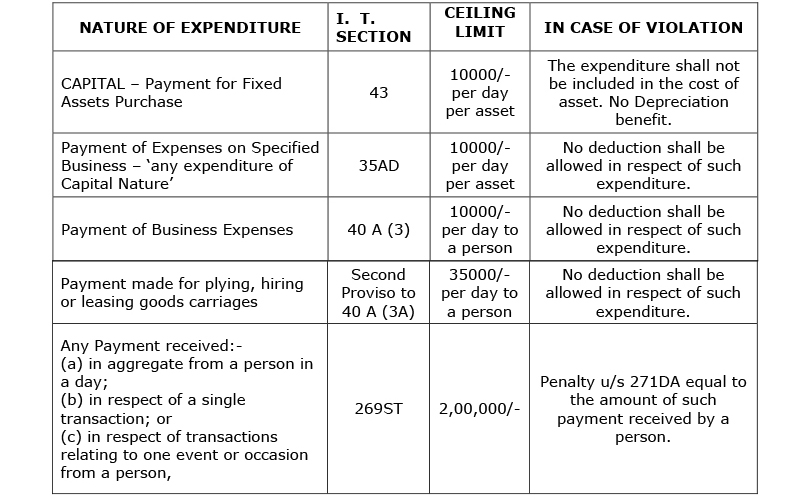

Restriction/ deterrence to cash transaction

In order to promote the digital economy, following restrictions have been imposed on cash transactions:

New provision: TDS @ 2% (Section 194N) on cash withdrawals above Rs. 1 Crores (in aggregate during a year) from an account in a Banking Company, Co-Operative Bank and Post Office w.e.f. 01-09-2019.

Also read: 6 tips to improve the financial health of your business

Image courtesy: shutterstock.com

To explore business opportunities, link with me by clicking on the 'Connect' button on my eBiz Card.

View Ritul 's profile

Most read this week

Trending

Comments

Share this content

Please login or Register to join the discussion