Focus on Your Core Expertise by Outsourcing Your Payroll

Finance & Accounting

531 week ago — 3 min read

In a recent study, Inc. magazine showed payroll to be the number one task for companies to outsource. The reason is obvious – outsourcing payroll allows business owners to free their time to focus on other important aspects of the business.

Managing various aspects of payroll (salary calculation, TDS working, computation of legal dues for PF, ESIC, Professional tax etc.) can be a time consuming and monotonous task.

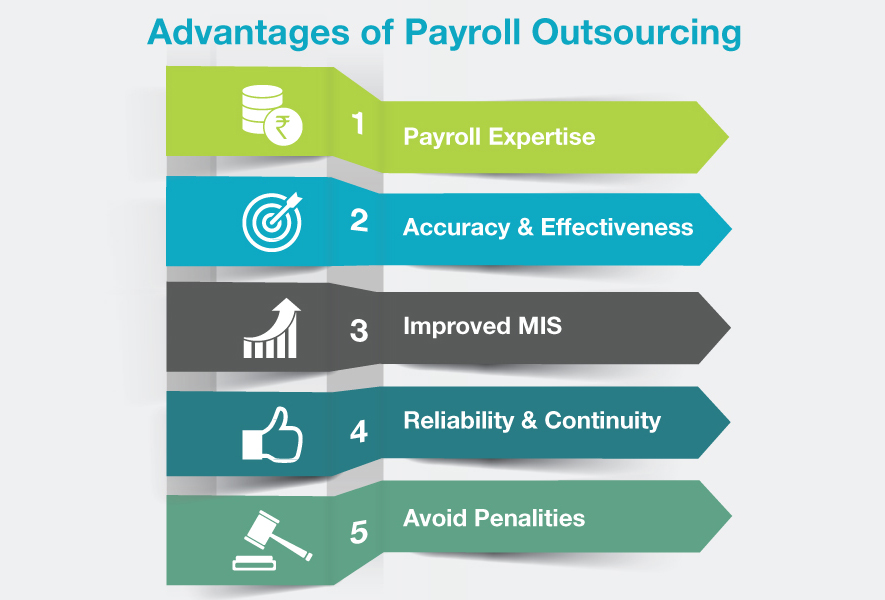

Here are top fives reasons why entrepreneurs and business owners should outsource payroll

1. Gain the advantages of payroll expertise

-

- With regular changes in government’s statutory acts like PF, ESIC, PT, LWF, TDS etc., it can be hard for most business owners and HR managers to stay abreast.

- Payroll service providers know the industry inside out and help comply with latest legislation and statutory requirements.

- By outsourcing payroll, business owners can ensure payroll is managed by payroll professionals and not by administrators.

2. Increase payroll accuracy & effectiveness

-

- If there are inaccuracies with payroll, it will have a direct impact on staff motivation and morale.

- Payroll service providers generally use latest technology available in the industry to process and manage, minimising chances of error.

3. Improve management information system

-

- Outsourced payroll can improve the quality of management information system.

- Business owners will be able to receive tailored management information and reporting, facilitating effective analysis and decision-making.

4. Reliability & continuity

-

- Payroll is fundamental to an organisation. Businesses that rely on a single member of staff to handle the payroll are placing themselves in a highly vulnerable position, if that person leaves or is absent.

- Outsourcing payroll can help ensure that there is a team of payroll professionals managing your payroll at all times.

5. Avoid inaccuracy and penalties

-

- Payroll processing involves legal compliance for TDS, PF, ESIC, PT, LWF etc.

- Incorrect calculations and delayed payments result in interest and penalties. For example, the Income Tax Department strictly monitors TDS compliances and levies penalty for delay in filling of TDS returns. Additionally, timely compliance with statuary requirements can help businesses avoid consequences or adverse actions prescribed under Income Tax Act, 1961.

Needless to say, these reasons justify the costs of outsourcing payroll.

Posted by

Sagar JivaniSagar Jivani is a creative & passionate entrepreneur, he focuses on providing the best HR services to MSMEs (Micro, Small, and Medium Enterprises) and also large scale...

View Sagar 's profile

Other articles written by Sagar Jivani

Leveraging Human Resources to Achieve Business Goals

539 week ago

Most read this week

Trending

Ecommerce 1 week ago

Comments

Share this content

Please login or Register to join the discussion