Optimal pricing with analytics

Business Development

342 week ago — 4 min read

Summary: The pricing of goods and services is an important determinant of ultimate profit margins. Lester Fernandes explains how with the help of analytics optimal pricing of products in retail can be achieved, thereby fulfilling the business objectives of a firm.

It is often accepted, based on economic theory, that an increase in 'price' of an item results in a decrease in 'quantity' sold. When retailers price their individual items, they are usually exclusively focused on the price dynamics of the item in comparison with competition or cost price or margins based on this theory and rarely based on maximizing the profit potential of selling the item itself. How can analytics in pricing of retail items help?

When the Pricing Team at retailers hear the Analytics Team recommending the optimal price of an item to be slightly higher or lower than the current price, the knee jerk reaction is a straight “No” based on the fact that the sales will likely be negatively impacted and the move will result in a lower total profit. I try to outline here an explanation of pricing & profit movement using a general understanding of business analytics.

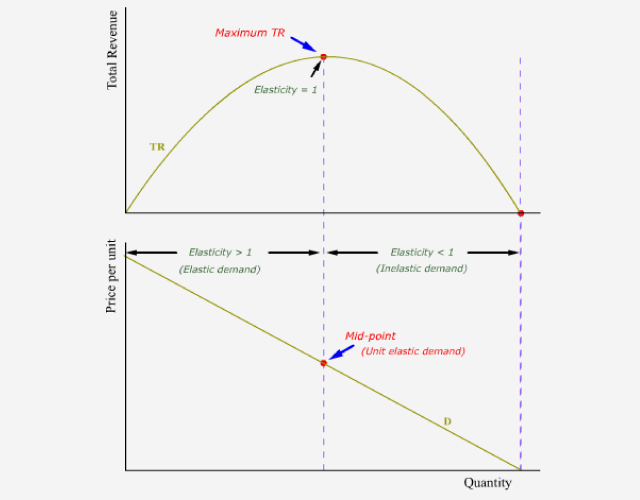

Two curves are depicted below in Fig 1. The one above is the Total revenue vs. the Quantity and the one below is the Demand Curve showing the Price per Unit vs. the Quantity sold. The Price per Unit = P, Quantity sold = Q and Total Revenue = P*Q. We can see that when P decreases, Q increases based on economic laws of demand. The Total Revenue will reach a theoretical maximum considering the inverse proportionality of P & Q i.e. the point of maximum Total Revenue [marked on the graph where Elasticity = 1].

Fig 1. Total Revenue vs. Quantity Sold and Price per Unit vs. Quantity Sold

The correct approach is to take the understanding from business regarding the Demand Curve for the item and then judge the Elasticity of the Demand. As can be seen from the figure above, retail prices within the Elastic Demand area can be increased till the point of Unit Elastic Demand. One the other hand, any price increase within the Inelastic Demand area will predict a further decrease in the revenue for that item and may not be advisable.

We, therefore, have to base the direction of the movement of the item price on the Elasticity of the Demand itself using the above guidelines. Business has to quantify whether the objective function is to maximize the revenues (profits) or increase the Quantity sold (to potentially increase the sales of another higher value item using Market Basket Analysis) or entirely something else. This will help Analytics figure out the best pricing approach given the desired business outcome.

There are various other factors governing the unit price movement of an item in a retail store that have not been accounted for. The oversimplified example above is to illustrate the use of Analytics to determine the optimal price to either maximize the profit or quantity sold or for any other objective function that may be known in advance.

To explore business opportunities, link with me by clicking on the 'Invite' button on my eBiz Card.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views, official policy or position of GlobalLinker.

Posted by

Lester Sebastiao FernandesI am looking to connect with other business owners who need to extract analytical insights from current data and take informed decisions. We make your Data Insights journey easier...

Network with SMEs mentioned in this article

View Lester 's profile

Other articles written by Lester Fernandes

Technology & business trends: 2019 & beyond

326 week ago

Most read this week

Trending

Ecommerce 4 days ago

Comments (2)

Share this content

Please login or Register to join the discussion